Google AdWords invoices - Where can you find them and what are the special features?

Finding Google Ads invoices, receiving them by email and VAT

Google Ads invoices regularly cause confusion - especially when all invoices have to be collected for accounting purposes at the end of the month and you don't have an Adwords agency to do this for you. You often notice that the invoice amount does not match the amount debited to your bank account or credit card account and that no VAT is shown. How to deal with the above-mentioned peculiarities and where to find Google Ads invoices is explained below.

Annoying with the Google Ads invoices, isn't it?

You would actually like better support for your Google Ads account. Don't hesitate to contact us for a friendly and completely free initial consultation!

DREIKON belongs to the close circle of Google Premier Partners. With us you reach a new level of performance. We will be happy to take a look at your Google Ads account and make you an offer to improve and optimize your Google Ads account.

Where can I find the Google AdWords invoice?

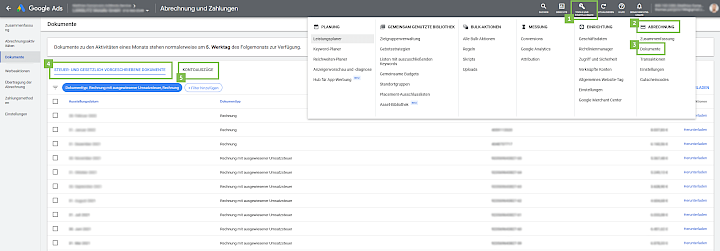

You can find the Google Ads invoices in your Google Ads account. To retrieve the invoices, simply click on the "Tools and settings" option in the top menu - this is marked with a wrench. There select the item "Billing" and then the menu item "Documents". Since December 2021, you will see the invoices without the overview of account statements. Unlike before, since January 2022 at the latest, the payments made are no longer listed directly in the invoice, but must be viewed manually. They can be called up under "Account statements". Under the sub-item "Payments received", you can see which payments have been successfully received in your account.

Submit the invoice document and the document for the "Payments received" together to your accounting department. In combination, the documents resemble the invoice that you were able to view in your Google Ads account before the changeover. For your records, you can either print out the pages or download them as a document.

You can always download or print your invoice for the previous month. Google Ads creates an invoice for each completed month. This can be downloaded as a PDF under "Invoice with EU VAT". The invoice for the last month is usually available to you from the first day of the following month. In rare cases, however, it may take more days - for example at weekends or on public holidays. In these cases, you will receive your invoice later.

Where can I find the account statements in Google Ads after the changeover?

Can't find the account statements straight away? Since the changeover, they are unfortunately somewhat hidden in your Google Ads account. Unfortunately, the account statements are not labeled or even linked as a first or second level menu item. A good Google Ads agency can always help you find Google Ads receipts for your accounts. We'll help you click through with this graphic:

What about VAT for Google Adwords invoices?

VAT is not included in Google Adwords invoices and is therefore not shown. This is because you use Google Ads for your business purposes and have provided a business address within the EU. Google therefore refers to the reverse charge procedure on your invoice. This means that Google shifts the tax burden to the domestic entrepreneur. You are therefore responsible for declaring and paying tax on the amount in your advance sales tax return. As the sales tax incurred is deductible, there should be no additional tax burdens as a result. At this point, however, we would like to point out that it may make sense to seek advice from your tax advisor in this case.

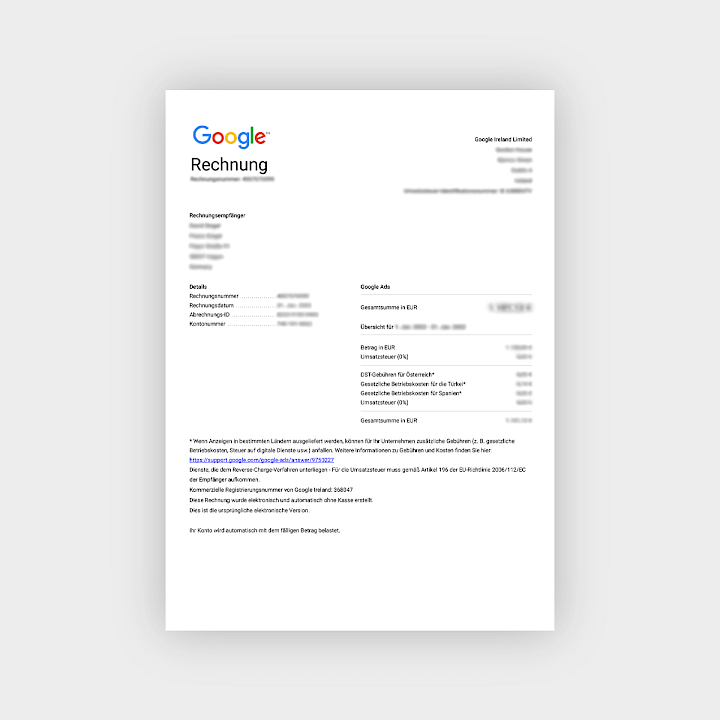

What does a Google Ads invoice look like?

As you can see from our example invoice, no VAT is shown. Instead, you will find a note below the invoice stating "(...) The recipient must pay the VAT in accordance with Article 196 of EU Directive 2006/112/EC." You can find more on this topic here.

How does Google charge?

Each month starts with an initial balance at Google, which is carried over from the previous month. If the advertising expenditure exceeds the balance, the Google account is automatically topped up by direct debit. At the end of each month, a final balance remains, which is then carried over to the new month as the starting balance. Google's invoice therefore has some special features, as two different amounts are listed on the invoice. The reason for this is the Google Ads credit system - in which Google first makes advance payments and only invoices the service provided at the end of the month. On the invoice, the costs that still have to be paid and previous payments received are listed. The costs, i.e. the invoice amount, are shown at the top of the invoice - your Google account will then be topped up by at least this amount. The second part of the invoice lists the payments that have already been made. If the advertising service has used up the credit, the Google account must be debited from your bank account or the credit card provided in order to top up the Google account with the agreed amount.

Why does the invoice amount on the Google Ads invoice differ from the account debits?

The invoice amount shown rarely matches the amounts debited. This is because you are charged for the service provided plus or minus the overages from the previous month. The resulting differences explain the differences in the receipts. You don't believe that? Here is an example to help you understand the billing system:

You need tutoring for your child for certain homework and before exams for 10 euros an hour. So that you don't have to worry about not having the money at home every time, you agree on an advance payment of 50 euros. As the learning effort varies depending on the subject and frequency of the exams, you agree that the tutor will let you know when the hourly quota has been used up - only then will further payments follow. Keep a written record of when and how many lessons have taken place. If only two hours of tutoring have been provided in one month, the new month starts with a credit of 30 euros that you can draw on. In this case, the invoice amount does not match the actual service booked - just like in Google Ads.

You are probably wondering whether the different amounts are a problem for the tax office. However, the different amounts are not usually a problem for the tax authorities. Everything you need to know about the terms "Initial account balance", "Total new activities", "Total corrections", "Payments received" and "Final balance" is listed in the "Statement of costs" section of the Google Ads invoice.

How do I receive the Google Ads invoice by e-mail?

If you use the payment setting for monthly invoicing, you can retrieve your invoices by email. Google will then send you your invoice by email within the first five working days of the month. To receive invoices, you must first confirm your e-mail address. The invoice will then include the previous month's charges. If you would like to receive your invoices by e-mail instead of by post for monthly invoicing, click on the tool icon, then click on "Settings" in the menu on the left and remove all addresses in the "Payment account" section in the "Invoicing by post" section. Then add your e-mail in the "Invoice delivery by e-mail" section. If you have any questions or problems, you can contact your agency or Google directly - Google has provided a dedicated support for billing problems.

Conclusion: The correct accounting

Once the differences and special features are clear, difficulties and confusion surrounding the Google Ads invoice quickly become a thing of the past. However, it is important to make sure that the amount actually paid is not just the invoice amount and that the VAT is registered and paid to the tax office. If you pay VAT yourself, you can also claim it directly as input tax.

Even more challenges than finding Google Ads invoices?

We are happy to help you even more! If you value personal and high-performance support in the area of Google Ads (formerly Adwords), then don't hesitate to contact us for a non-binding initial consultation!

Finding a Google Ads invoice is easy

The question "Where can I find Google Adwords invoices?" was answered quickly. You also received an answer to search terms such as Google Ads invoice by email or Google Adwords invoice sales tax. If you would like support in the area of Google Ads and a perfectly managed Adwords account, then don't hesitate to call us or send us an e-mail.